THIS MATERIAL IS A MARKETING COMMUNICATION.

2021 Review of China’s Consumer Sector

As China’s middle class continues to expand, consumption has become a key driver of growth for the country. However, 2H21 saw a slowdown in consumption across China due to weak macroeconomic conditions and strict COVID-19 controls. In particular, the consumer discretionary sector has been impacted, along with service industries such as tourism and restaurants. Meanwhile, local brands continue to maintain popularity in China, fueled by the rise in patriotism amid ongoing US-China tensions.

2021 also marked a year of regulatory crackdown, with Chinese regulators introducing a series of legislations on topics such as anti-trust, data security, afterschool education, and other issues. The connecting link between these numerous regulations is China’s pivot to common prosperity. After years of pursuing high growth, common prosperity seeks to develop more high-quality growth, with a goal of growing the size of middle class. In the long run, we believe this will drive more sustainable development and benefit consumer companies in China. Meanwhile, we expect consumption to recover next year as the government shifts to loosening fiscal and monetary policy and gradually relax COVID-19 restrictions after the Beijing Winter Olympics in February 2022.

Common Prosperity

Market participants initially displayed concerns over common prosperity, especially wealthy individuals who feared they’d be targeted with various tax implementations. From a consumption perspective, this would have an impact on high-end and luxury spending in China, including the demand for premium baijiu brands. However, over a series of press releases shared by the government, it became apparent that the focus of common prosperity is to support the lower-income class population to become part of the middle class, rather than targeting wealthy consumers. Thus, this policy is not new but is actually in-line with the government’s changing focus from growth-first to striking the balance between growth and sustainability. It also supports their continued efforts to make China a domestic consumption-driven economy, which has been emphasized for many years.

According to Morgan Stanley, China’s middle class may double in size from 400mn people in 2020 to 800mn by 2030.1 This should benefit overall consumer brands across various categories and segments – from food and beverages to sportswear, cosmetics, and automobiles, even service industries such as restaurants, are all expected to benefit from an increase in demand.

Strong Local Brands

The “guochao” (国潮) trend continued its momentum throughout 2021, particularly for sportswear brands such as Li Ning and Anta. The trend took off following the Xinjiang Cotton issue in March 2021, though initially the companies expected that the hype would gradually fade away. However, the trend continued to persist and led to robust sales growth of local sportswear brands, despite the overall weak consumption environment. Leading companies like Li Ning and Anta have been able to secure better store locations in shopping malls and have expanded direct to consumer (DTC) channels by operating their own retail stores alongside their online business. In addition, both companies have launched new brands, such as Li Ning 1990 and Anta Champion, targeting different consumer segments to capitalise on the guochao trend.

Meanwhile, China announced a five-year plan with significant investments for the sports industry. The government intends to transform the industry into a 5 trillion-yuan industry by 2025,2 targeting better access and participation in sports, mass fitness events, and stepping up the war against adolescent obesity. The government’s strategy will also require schools to implement an hour of physical activity on a daily basis. We expect leading local sportswear brands to prosper on the back of both the government’s support for the sports industry as well also consumers’ preference for local brands.

Li Ning and Anta Sales Trend

Li Ning PRC Sales by Channel

Source: Company data, Morgan Stanley, September 2021

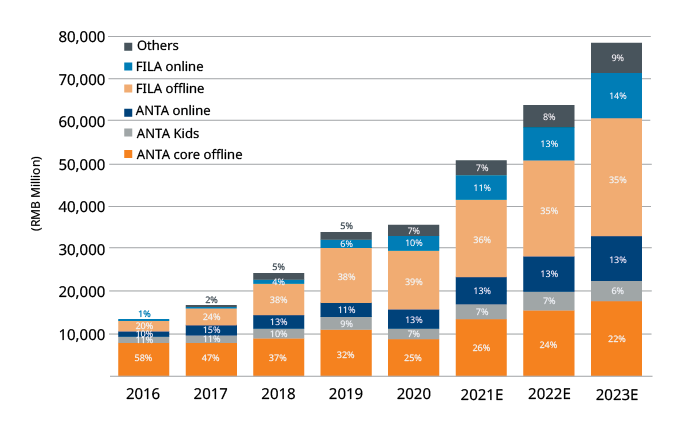

ANTA Sales by Segment

Source: Company data, Morgan Stanley, September 2021

Electric vehicles (EV), or new energy vehicles (NEV), is another key industry with strong government support. Despite the global chip shortage and overall consumption slowdown, China NEV sales recorded 2.3mn units sold year-to-date October 2021 and is expected to reach over 3mn for the full year 2021.3 NEV penetration reached a historical high of 20% in August 20214 and, more importantly, we’ve seen local brands outperform in this segment. BYD, a Chinese NEV manufacturer, is expected to surpass Tesla in terms of market share in December 2021 and local brands overall accounted for ~80% of NEV sales in China this year.5 Like China’s leading sportwear companies, we expect local NEV brands will continued to experience robust growth momentum thanks to strong government and consumer support.

Outlook for 2022

Reflecting on the consumption slowdown in 2H21, the consumer services industry was hit the most with the government’s zero-COVID approach. Restaurant industry sales had just recovered to pre-COVID levels in June/July 2021 when the government introduced tighter social distancing measures with the resurgence of COVID-19 around August. Subsequently, industry sales dropped to 70% of normalized levels and is still yet to make a recovery.7 Weak macro landscape and ongoing COVID-19 restrictions led to a soft consumption environment, which we expect may gradually recover next year.

The government has now shifted to loosening its policy with an RRR cut in December. We expect more supportive measures will be implemented over the coming months which should help stabilize the domestic economy in China. In addition, we expect more relaxation on social distancing measures on the back of rising vaccination rates in the country and, more importantly, after the Beijing Olympics has been held in February 2022. This should lead to overall recovery in consumption as well as performance of major consumer brands next year.

1. Development Research Center, The Economist, Morgan Stanley Research, September 2021

2. 国务院关于印发全民健身计划(2021—2025年)的通知(国发〔2021〕11号)_政府信息公开专栏 (www.gov.cn); State Council, August 2021

3. Credit Suisse Research, November 2021

4. JP Morgan Research, November 2021

5. Credit Suisse Research, November 2021

6. Original Equipment Manufacturer (OEM); State Owned Enterprise (SOE)

7. Macquarie Research, August 2021

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus. This document has been approved for issue in the United Kingdom by Mirae Asset Global Investments (UK) Ltd, a company incorporated in England & Wales with registered number 06044802, and having its registered office at 4th Floor, 4-6 Royal Exchange Buildings, London EC3V 3NL, United Kingdom. Mirae Asset Global Investments (UK) Ltd. is authorised and regulated by the Financial Conduct Authority with firm reference number 467535.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.