THIS MATERIAL IS A MARKETING COMMUNICATION.

Hong Kong’s Financial System Remains Stable

The Hong Kong Monetary Authority (HKMA) has intervened after months of weakness in the Hong Kong Dollar (HKD) to maintain the HKD

Keynotes

- The mechanism for Hong Kong’s peg with the US dollar remains intact. Though aggregate balance has fallen throughout 2022, Hong Kong’s foreign exchange (FX) reserve is still large, with more than enough to cover the size of its monetary base, M0.

- If the US imposes financial sanctions against Hong Kong, then the HKD may have to be pegged with the Chinese Yuan. However, we see this as an unlikely black swan event.

Hong Kong’s Linked Exchange Rate System Still Robust

There have been many concerns regarding Hong Kong’s ability to maintain its currency peg with the dollar in recent months due to the fastest rate hike cycle in the US this year, recent capital outflows, and rising tension between US and China.

The HKD has been pegged to its counterpart USD since 1983 and trades within a permitted range of 7.75 to 7.85 HKD per USD. The stability of the Hong Kong Dollar exchange rate is maintained through an automatic interest rate adjustment mechanism and commitment by the HKMA.

This year’s strengthening of the USD and the weak side of the Convertibility Undertakings (CUs) has triggered intervention by the HKMA to uphold the peg. As a result, Hong Kong’s foreign exchange reserves have fallen, and interest rates in Hong Kong have recently started to rise.

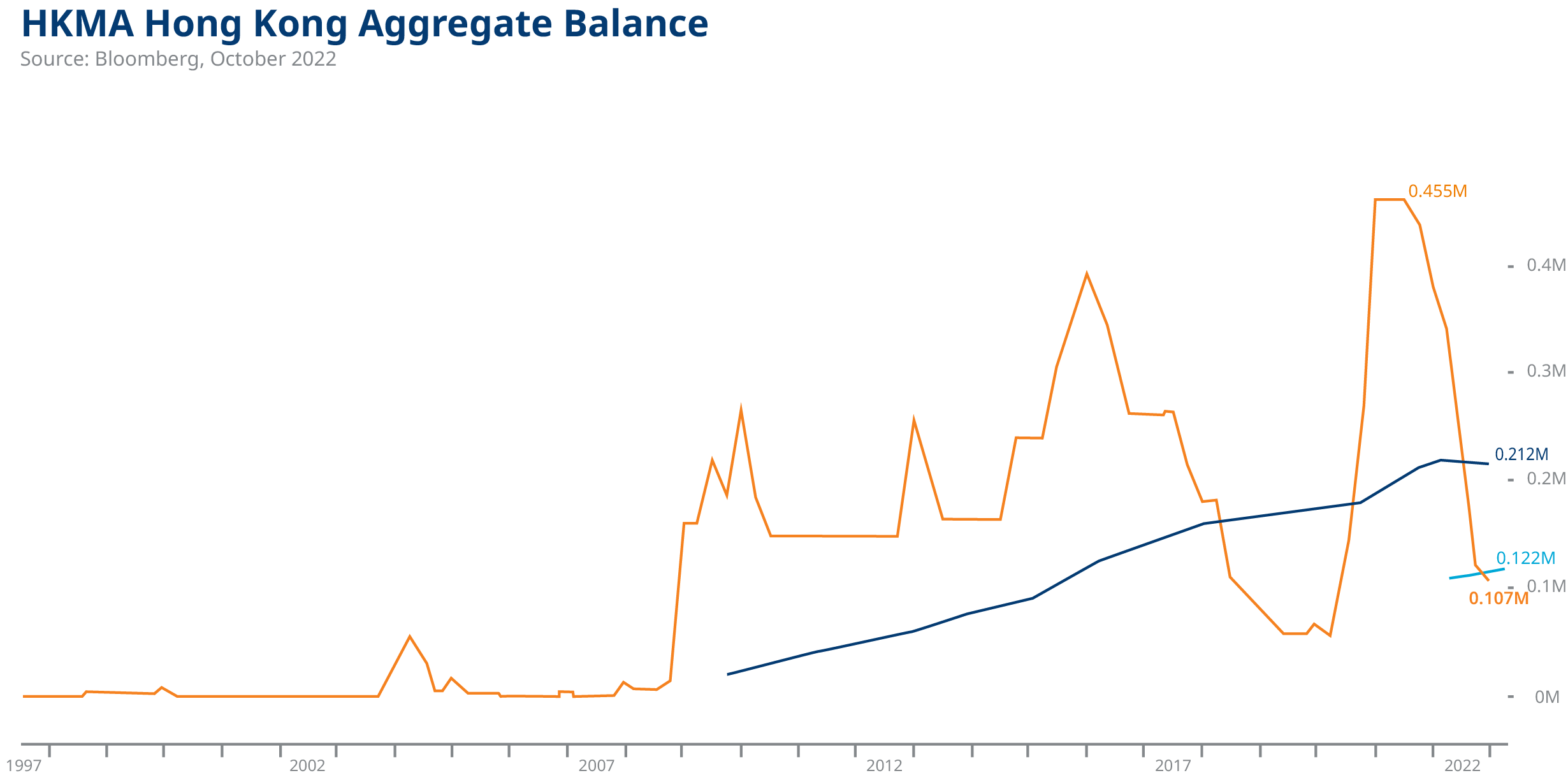

Some investors confused the aggregate balance (a component of the Monetary Base) with the foreign exchange reserve. They worried that with the fast decline of the aggregate balance, the reserve might be depleted, and hence the peg might break down.

In fact, the aggregate balance is the sum of balances in the clearing accounts and reserve accounts maintained by commercial banks with the central bank. It represents the level of interbank liquidity. When the banking system is flooded with liquidity, the aggregate balance increases; when Hong Kong dollars flow out, the aggregate balance falls. Less interbank liquidity means local commercial banks have to raise interest rates (following the US rate cycle) to halt capital outflows and alleviate the downward pressure on the Hong Kong dollar.

Meanwhile, Hong Kong’s foreign exchange (FX) reserves are still large, more than enough to cover the size of Hong Kong’s monetary base, M0.

Change of System is a Black Swan Event

Hong Kong’s peg with the US dollar aligns with its national strategies and cements its position as a global financial centre. In Hong Kong Chief Executive John Lee’s recent maiden policy dress, he reaffirmed and introduced measures to enhance Hong Kong’s competitiveness as an international financial centre, to attract top global talent and enterprises. However, earlier this year, Financial Secretary Paul Chan and HKMA Chief Executive Eddie Yue did warn that Hong Kong must plan for various risks after the US weaponized SWIFT to sanction Russia.

In a nutshell, we don’t think it’s in the best interest of the Hong Kong government to disrupt the current dollar peg system and it will not seek to change the arrangement. However, in the event of an extreme scenario with the US imposing financial sanctions against the Hong Kong Special Administrative Region (SAR), the Hong Kong dollar might have to be pegged to the Chinese Yuan.

COM-2023-01-19-HK-R-MKT-HKFINANCIALSTABILITY

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus. This document has been approved for issue in the United Kingdom by Mirae Asset Global Investments (UK) Ltd, a company incorporated in England & Wales with registered number 06044802, and having its registered office at 4th Floor, 4-6 Royal Exchange Buildings, London EC3V 3NL, United Kingdom. Mirae Asset Global Investments (UK) Ltd. is authorised and regulated by the Financial Conduct Authority with firm reference number 467535.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.