THIS MATERIAL IS A MARKETING COMMUNICATION.

India Market 2025 Outlook

While the macro environment has become more challenging for emerging markets, including India post the US election, we believe Indian equities should remain relatively insulated from the macro headwinds of a stronger dollar and the US tariffs risks.

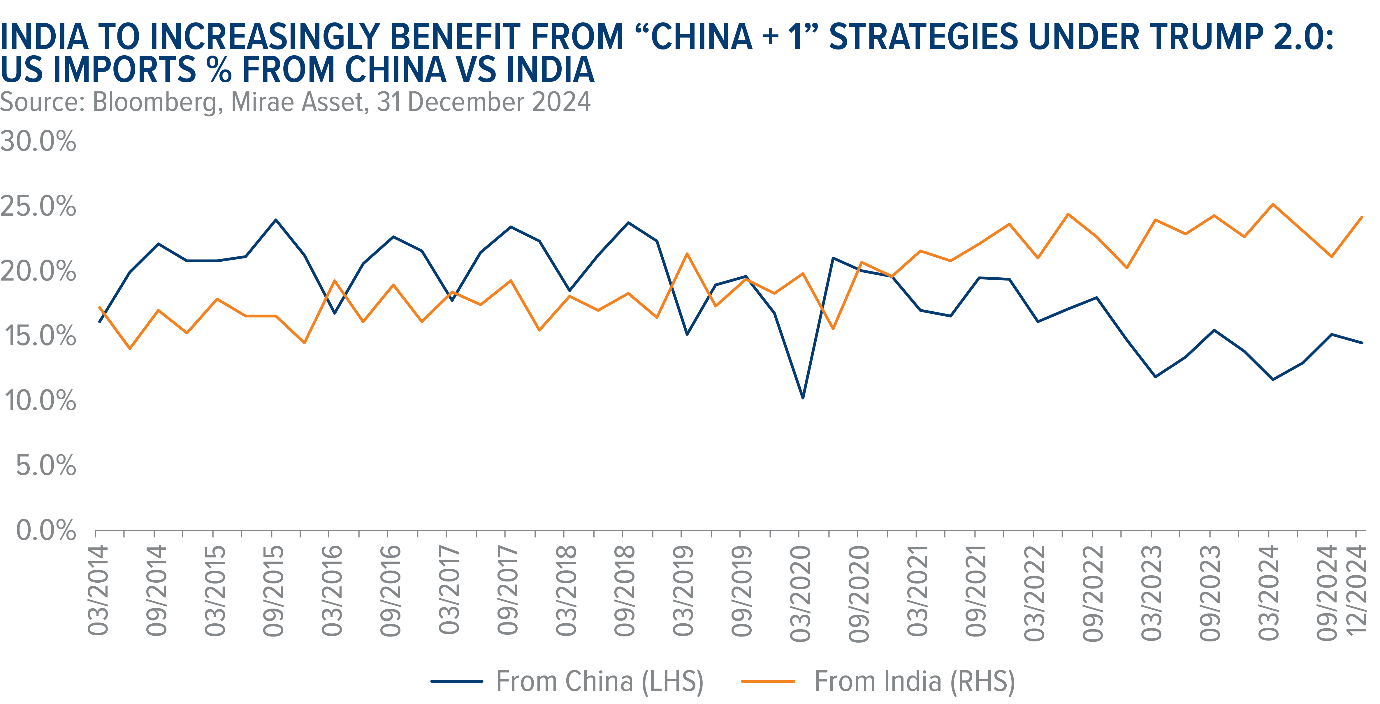

India is still largely domestic demand driven economy with consumption contributing nearly two-thirds of GDP, and an investment upcycle is expected to continue over the next several years. The US contributes only 10-15% of India’s exports, primarily in IT services and Pharmaceuticals, which may have a limited impact from the tariff risks. On the other hand, we believe India may benefit from the current geopolitical situation as well as from multinationals’ “China + 1” strategies as India is now in a much better position than in previous years to attract more investments and thus gain more shares in global manufacturing industries. We believe investing in sector leaders will be a good strategy to navigate macro uncertainties while capitalising on India’s structural growth story.

We believe “Trump 2.0” administration may bring more opportunities than risks to India, as the country is now much better prepared to attract more investments from multinational companies’ reshuffling their supply chain. This preparedness is supported by better infrastructure, supportive government policies, and a growing base of affordable consumers, which creates a large consumption market. Companies like L’Oreal and Schneider Electric have already held their global analyst meetings in India in 2024, and we expect more companies to follow in coming years. Despite India was not a primary beneficiary of the previous US trade tensions, much has changed since then. We expect India to receive more foreign direct investment (FDI) not only in high-tech sectors but also in mid-tech sectors like textiles and small electrical goods, which tend to be more labour-intensive by nature and are crucial for job creation. The “Make in India” initiative has been one of the key priorities for the Modi government over the past decade, and after the government regained strong leadership post the Maharashtra state elections, we expect the Central government may continue to undertake various reforms to achieve its “Make in India” goal.

We see the current economic slowdown as transitory and expect growth to rebound in 2025. Government capex has slowed in 1HFY25, largely due to national elections, disruptive weather, and seasonal factors. However, we have witnessed government spending picking up in 3QFY25, which will continue in coming quarters. In addition, the housing cycle remains strong with a low level of inventories.

More importantly, private capex is expected to take the baton from the government moving forward. Private corporate capex is expected to increase considering strong balance sheets and opportunities in various sectors including power, electrification, Production Linked Incentive (PLI) schemes etc. We have also seen an increase in bank-approved projects, which should soon translate into private corporate investments, leading to a better earnings cycle.

Consumption growth has also slowed in recent quarters, particularly in urban mass consumption, which has experienced a cyclical downturn due to high food inflation and a slowdown in unsecured consumer credit after Reserve Bank of India (RBI) pre-emptively tightened credit growth, especially on unsecured consumer loans since late 2023. We expect credit growth to stabilise from here as it has now come down to similar level of deposit growth. Furthermore, RBI is shifting to an easing monetary cycle, with interest rates likely to be cut in 1QCY25.

While we are closely watching out for food inflation, we expect a generally stable inflation environment for 2025 on the back of benign oil prices. Meanwhile, rural consumption has remained resilient and continues to show gradual improvement. In addition, premium consumption among affluent Indians - such as travel, luxury hotels, private hospitals and premium properties - has shown solid demand. Thus, we prefer to stick with consumer services where demand remains strong for the time being, as we navigate the cyclical slowdown in mass consumption.

While we expect some headwinds from the global macro environment, we believe India’s structural growth story remains intact and is expected to be one of the fastest-growing economies in 2025. Thus, we believe investing in sector leaders with strong management teams will be the best way to navigate tough times amid increased uncertainties while capitalizing on potential growth opportunities. Furthermore, we prefer to focus on sectors with strong demand, such as travel, internet/quick commerce, power, and hospitals, which offer high earnings visibility.

February 05, 2025

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus. This document has been approved for issue in the United Kingdom by Mirae Asset Global Investments (UK) Ltd, a company incorporated in England & Wales with registered number 06044802, and having its registered office at 4th Floor, 4-6 Royal Exchange Buildings, London EC3V 3NL, United Kingdom. Mirae Asset Global Investments (UK) Ltd. is authorised and regulated by the Financial Conduct Authority with firm reference number 467535.

Authors: Sol Ahn (Licensed by the Securities and Futures Commission for Types 4 and 9 regulated activities under the Securities and Futures Ordinance), the author and her associate(s) do not hold the securities/fund mentioned in the article.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.