THIS MATERIAL IS A MARKETING COMMUNICATION.

Introduction to Foundry Industry

In this article, we will introduce the foundry sector and its importance to the wider semiconductor industry.

Why are foundries so important?

There are two business models in the semiconductor industry, namely integrated circuit manufacturer (IDM) and pure-play fabless and foundry. An IDM both designs its own integrated circuit (IC) and produces it in-house. Intel, for example, falls into this category. The other model separates the process of design and production. A fabless company is only in charge of design, like Qualcomm and Mediatek, while a foundry or fab focuses only on production, like TSMC.

Foundries play a crucial role in integrated circuits supply as many top semiconductor companies have shifted their resources to chip design over the years and do not have large scale manufacturing capabilities. Foundries have also been leading the process node migration, which is the core that enables performance improvement of integrated circuits.

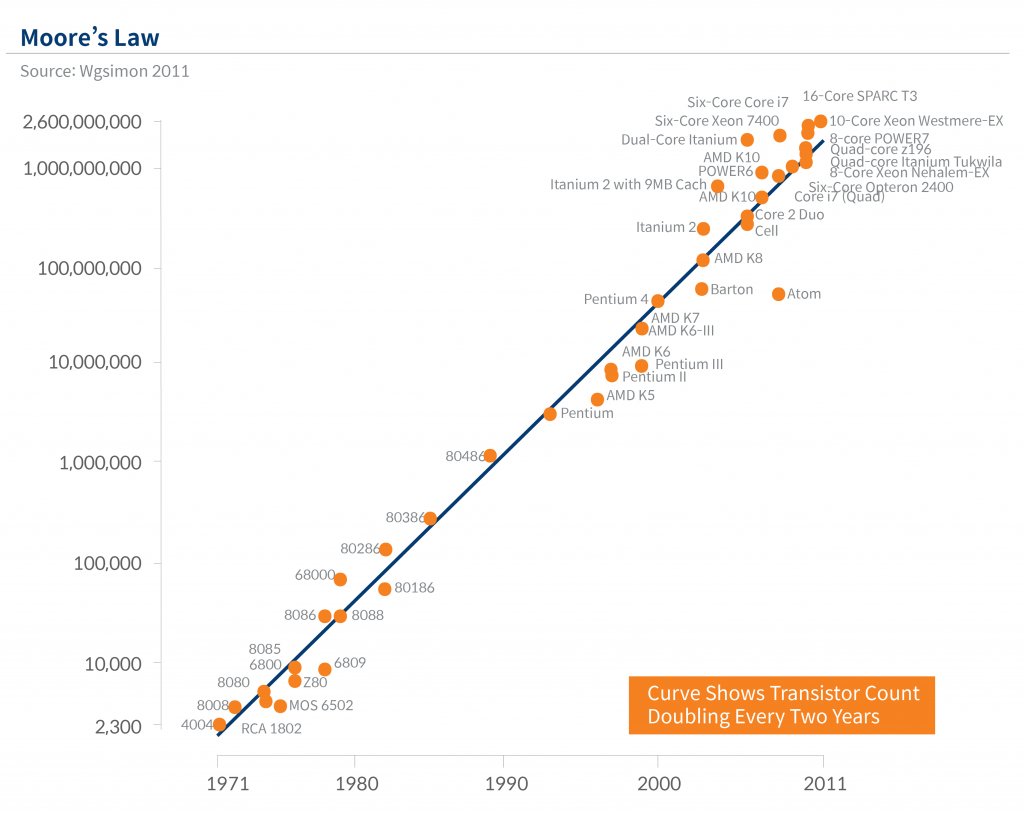

Foundry process migration works on shrinking the distance between transistors, which has allowed more transistors to be packed into a fixed area, achieving higher logic density with better power efficiency. Gordon Moore, the co-founder of Fairchild and Intel, predicted that the number of transistors in integrated circuits doubles about every two years back in 1975, which has since become known as the ‘Moore’s law’. This enables the industry to make faster Central processing unit (CPUs) and larger memories. Today the smartphone in your pocket is much more powerful than the Apollo 11 guidance computer.

Why is the industry so concentrated?

In order to understand the dynamics of the foundry business today, we must look at the history of foundries. Before TSMC was founded in 1987, most integrated circuit companies operated an IDM model with in-house design and manufacturing. TSMC and other foundries have developed this new business model of separating chip design and manufacturing. Overtime, IDM has been losing market share to foundries and fabless companies. One key reason is that process node migration requires significant capital investment and a high utilization rate to be profitable, which makes it increasingly difficult for IDM companies.

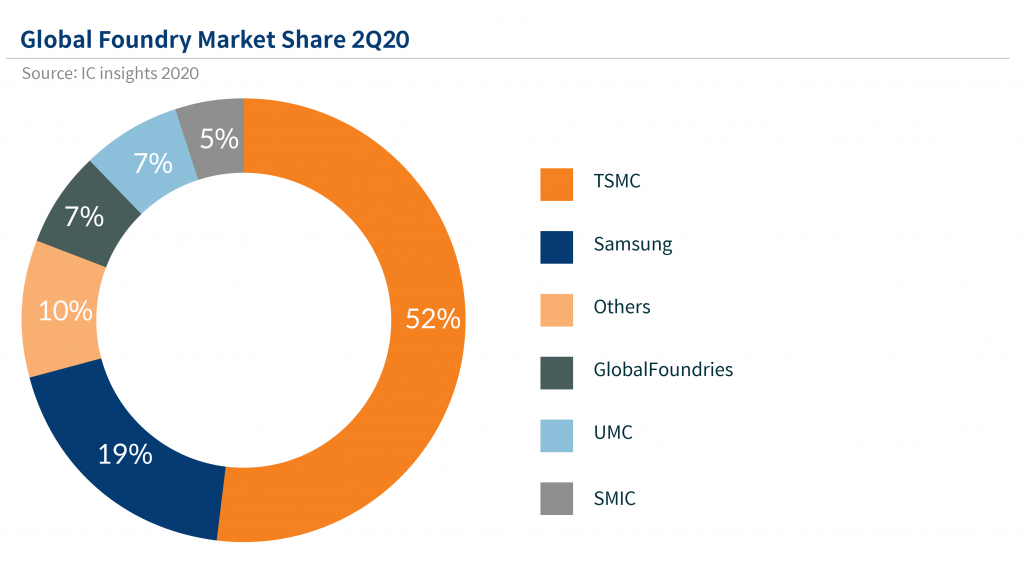

The foundry industry is highly concentrated, with the top three foundries accounting for over 78% of the global market share in 2Q20.1 This is the result of significant capital expenditure required to migrate in the advance process. Capital expenditure for TSMC for example was US$15bn in 2019, over 26 times more than that of the fourth largest foundry Global Foundries. Meanwhile, the chip manufacturing process requires close collaboration between foundries and fabless companies and qualification time is lengthy and costly with fabless companies, making it difficult for new entrants to break into the existing market.

![]()

Competitive Landscape

There are only three companies which have plans for further technology migration to produce node process below 10nm, namely TSMC, Samsung and Intel. TSMC has been leading the industry since the 14nm process. It started mass production of 7nm node in 1Q18, almost two years earlier than the closest competitor Samsung, and over four years ahead of Intel’s most optimistic 7nm progress projection. Samsung, which starts to ramp up on the 7nm process this year, has an aggressive timeline (see charts below) to catch up on 5nm and 3nm nodes. The company has 19% market share by revenue as of 2Q20, second behind TSMC.2

Intel said in its 2Q20 results presentation that its 7nm node launch date would be further delayed by another six months from the originally planned launch at the end of 2021. It will be a full year behind its target. Management indicated the possibility to outsource production of some chip products to third-party manufacturers to alleviate the delays.

We estimate China’s foundry market share to be around 6% in FY19.3 We see significant room for domestic companies to capture market share in the foundry space due to the current low localization level. Government support and funding will allow domestic companies to invest more in R&D for node migration. The emergence of Chinese fabless companies will also support the growth of local foundries as they are more likely to rely on domestic suppliers.

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus. This document has been approved for issue in the United Kingdom by Mirae Asset Global Investments (UK) Ltd, a company incorporated in England & Wales with registered number 06044802, and having its registered office at 4th Floor, 4-6 Royal Exchange Buildings, London EC3V 3NL, United Kingdom. Mirae Asset Global Investments (UK) Ltd. is authorised and regulated by the Financial Conduct Authority with firm reference number 467535.

Copyright 2024. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.