THIS MATERIAL IS A MARKETING COMMUNICATION.

Monthly Commentary on Key Themes – August 2024

China Electric Vehicle and Battery

- Solid July EV Sales; NEV penetration close to 50%: According to CPCA estimate, July passenger NEV wholesale volume reached 950k, +29% YoY.1 Individual auto brands reported divergent July Sales. BYD reported July NEV sales of 341k units, +31% YoY, with PHEV continuing to record strong growth. Overseas sales reaccelerated to 30k units from 27k units last month.2 Li Auto delivered 51k units in July, +49% YoY and reaching a historical high level. Nio (flat YoY) and Xpeng (+1% YoY) recorded softer sales momentum in July. Based on insurance registration, new energy vehicle (NEV) penetration was 48% in the last week of July.3

- Auto trade-in program upgraded: The trade-in stimulus has been doubled to Rmb20k (from Rmb10k) per NEV, and Rmb15k (from Rmb7k) per eligible ICEV,4 following central government’s indication that long-term government bonds could be used to fund consumer goods trade-in.5 More than 113k vehicles sold from 26 April to 25 June applied for the trade-in subsidy, according to Ministry of Commerce.

- Battery material costs further declined in July: China’s spot lithium carbonate price declined by 6% MoM to around RMB 87 k/t at the end of June.6 Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

Stock Comments

CATL’s share price was up 3.5% in July. CATL reported solid 2Q24 results on 27 July. Net profit of Rmb12.3bn was +13% YoY7 on both battery sales and margin expansion, with unit profit for both EV and ESS batteries remained stable QoQ. New products Shenxing and Qilin are taking up 30-40% of total EV battery sales volume, and management expect the ratio to rise further. 8

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand, as stimulated by scaled-up auto trade-in program, together with export sales, should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive in 2024 with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands.

China Clean Energy

Industry Update:

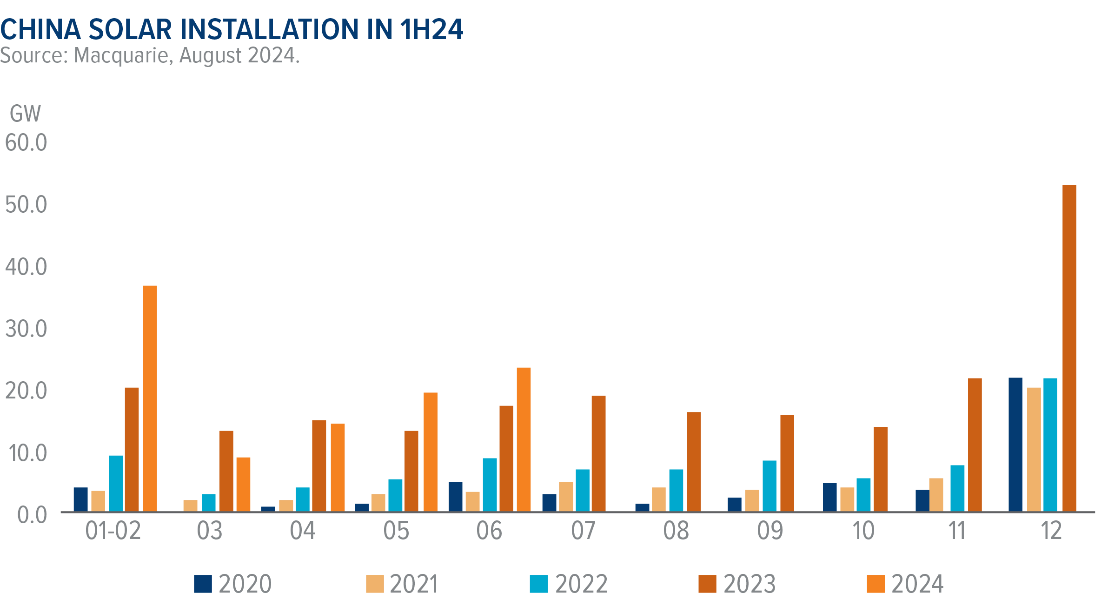

China power demand growth rose by 8.1%yoy to 4,658bn KWh in 1H24, while China added 153GW of power capacity, +14%yoy including 102.5GW solar and 25.8GW wind, +31%yoy and 12%yoy, respectively. China also significantly increased the investment in power grids to Rmb600bn in 2024, to better utilize the power generation by renewables. We witnessed wind sector rally due to positive progress on the multiple offshore wind projects recently. Most of the offshore wind farms in the pipeline are in deep and far sea areas which are likely to start construction over the 15th Five-Year Plan(2026-2030E). On solar side, supply chain prices remain sluggish due to oversupply. Polysilicon, wafer, cell and module players are still bleeding, despite strong volume growth. We have seen some small players start to exit and more new capacities plan get deferred or cancelled.

Stock Comments

Ningbo Deye Technology: The company is one of the key exporters who are selling residential solar inverters to Europe and other major overseas market. Thus, company benefits from global solar installation accelerating, especially after destocking in Europe. In 1H24, company still maintained solid revenue and earnings YoY growth.

China Three Gorges Renewables: The company is a leading wind farm operator in China, who benefits from wind manufacturing cost decline. It was also seen as a defensive play with power generation output growth as utilities name.

TCL Technology Group: The company was one of the top two solar wafer makers in China who suffered from severe wafer oversupply currently. Gross margin in wafer end turns negative this year. It takes time for small players to exit.

Preview

We remain constructive on the global clean energy growth and the trend of energy transition. However, we also must admit the near-term broad mismatch between supply and demand along solar/wind supply chains, which led to poor earnings for a couple of months or maybe even longer. It takes more time than expected for the small players to exit and demand to catch up, especially when China solar value chain are faced with geopolitical pushback from the United States. On the bright side, we have seen strong demand from some emerging markets like ASEAN, Middle East regions, Africa and South America, but it still needs more time.

China Consumer Brand

Industry update

In June, China's retail sales growth slowed to +2% YoY, compared to a rebound of 3.7% YoY in May. Sectors such as Cosmetics, Sports & Entertainment Equipment, and Electronics & Appliances exhibited noticeable deceleration in YoY growth, possibly due to growth normalization post an earlier 618 online shopping festival and subdued consumption sentiment. Restaurant & Dining and Food, Grain, and Oil experienced a slight acceleration in growth. The YoY decline in Gold & Jewellery also narrowed as gold prices stabilized.

In July, we observed positive indications in policy trends. The NDRC and MoF jointly announced to support the trade-in of appliances and large industrial equipment (such as trucks, buses, ships, etc.) with ultra-long-term special treasury bonds amounting to Rmb300billion. Of this total, Rmb150 billion will be allocated for trade-ins of home appliances. In the July Politburo meeting, boosting consumption was highlighted as a key priority in the second-half policy directives. The announcement emphasized a shift in policy focus towards bolstering household livelihood support and promoting service consumption.

Stock Comments

Techtronic Industries recorded gain of 6% in July. Techtronic's well-diversified capacities and strategic battery procurement position it well to navigate potential trade frictions effectively. Coupled with a seamless CEO transition, Techtronic's fundamentals remain intact on its leadership in cordless technology transformation.

Li Auto recorded gain of 9% in July thanks to robust sales and order performance, particularly with its L6 model since late June. Li Auto could further enhance its market presence in lower-tier cities through channel growth and the competitive pricing, especially as its primary competitor, BBA, grapples with issues related to channel management and price war. Additionally, Li Auto enhanced its NOA feature in July, which is now accessible on all roads nationwide, significantly narrowing the gap with industry leaders.

Trip.com Group corrected 16% in July, underperform HSTECH of 1% decrease. This is mainly due to deteriorating domestic RevPAR and concerns about the impact spreading to its outbound business

China Cloud Computing

Industry Update

China software industry growth in June at +10.9% YoY (vs. May at 11.8% YoY), slowing down from last month, leading 1H24 revenues +11.5% YoY (vs. strong growth at 14.3% YoY in 1H23), due to slower software spending amid macro weakness, and IT budget towards infrastructure and computing space.

Stock Comments

Alibaba share price performance was solid driven by multiple factors: 1) Taobao-Tmall Group announced several merchant policy adjustments. Tmall waived annual fees for merchants and Taobao started to charge 0.6% software services fee, which is likely to result in a net positive impact to take rate and profitability, 2) market expect growth gap between GMV and CMR to further narrow for the upcoming quarters, and 3) potential inclusion to the Stock Connect as early as September 2024.

Glodon Company share price moved up as it seems like previous correction was overdone and most of the negative headlines are already priced in. Overall demands from end-customers remained weak which will weight on revenue growth in the near-term, but the company continues to improve margin on better cost controls.

iflytek posted 1H24 preliminary results with both sales and bottom line missing consensus. Worsened profitability in 1H24 was mainly due to LLM investments, increasing bad debt provisions and less other income. Spark LLM v4.0 was launched end June-24, with eight areas said to beat GPT-4 Turbo, according to the management.

Kingdee International Software, market became increasingly concerned on 1H24 revenue and earnings heading into the results. ARR is likely to be under pressure as subscription among Medium enterprise and SME growth is weaker compared to previous quarters.

Preview

Most of the software companies reported earnings miss for 1H24 due to delayed IT spending by enterprises amid macro weakness. In particular, SMEs and private enterprises are seeing continuous IT spending decline whereas government and SOEs’ IT spending also slightly disappointed. Software companies have seen increasing account receivable days which negatively impacted working capital. Into 2H24, we see better seasonality of software business but the pace of recovery will be more or less gradual. On margin, software company's cost control measures will gradually take effect on profitability.

India

Industry Update

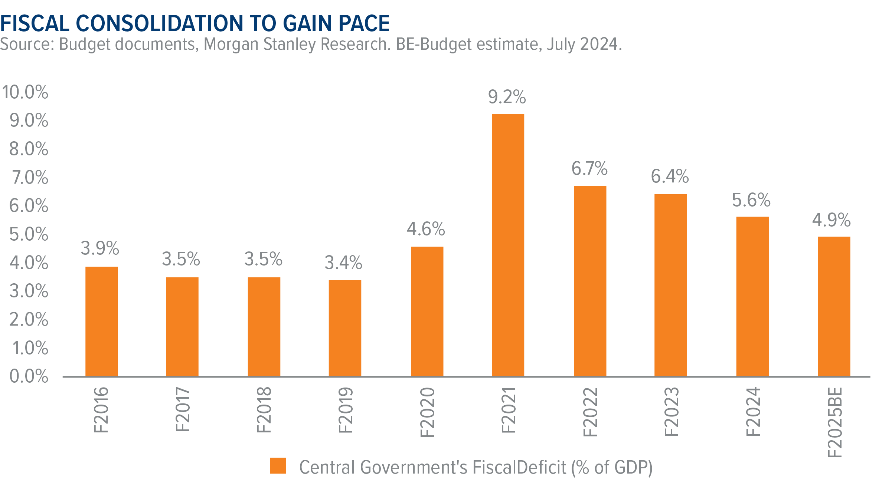

FY2025 budget focused on fiscal consolidation while keeping momentum on capex investments and focusing on enhancing skills and job creation for sustainable growth. The government targeting fiscal deficit of 4.9% of GDP for FY25 came in as a surprise to market as this was lower than 5.1% of GDP shared during interim budget earlier this year. Overall capex for FY25 came in line with the expectation as well as interim budget which is Rs 11.1tn or 17.1%yoy growth. CAPEX is expected to increase to 3.4% of GDP in FY25E from 3.2% of GDP in FY24. Meanwhile, there was no major surprise on rural spending, in fact, overall social sector spending is expected to moderate driven by lower core subsidy in FY25. That said, the government laid particular focus on employment and skill enhancement which is more important and structurally positive for India’s mid to long term growth outlook.

Monsoon has been strong so far this year and consumption growth is expected to be broad based with improving trend in rural demand. For instance, FMCG sales have shown rural outpacing urban in 4QFY24 as well as 2 wheelers sales outpacing 4 wheelers in recent months. Consumer sentiment in India also have surpassed pre-pandemic levels. While food CPI remains sticky, core CPI continues to trend down further leading to overall headline CPI to stay at 5.08% in June.

Stock Comments

Infosys reported revenue growth of 3.6%qoq, 2.5%yoy compared to consensus estimate of 2.3%qoq. EBIT margin expanded 100bp qoq reaching 21.1%. The company raised the FY25 revenue guidance band to 3-4%yoy from 1-3%yoy earlier. The management shared that they are seeing early signs of improvement in the US financial services while the broader environment for discretionary spends remains unchanged. Overall IT services sector have performed well this month as the market believes the worst is behind for the sector after the company’s results.

HDFC Bank - Overall loan growth was muted as the bank aiming to bring LDR down to pre-merger levels of ~85% from 104% in 1QFY25. The street now expects weaker loan growth as the bank is slowing down balance sheet faster than expected, hence this has led to earnings cut for FY25 after the results and also underperformance of the stock during the month.

Preview

This confluence of strong GDP growth, moderate inflation, and recovery in consumption suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on India market.

Asia Semiconductor

Industry Update

TSMC reported strong result and guidance

TSMC raised its full year revenue guidance to "slightly above mid-20%s" YoY (from low to mid 20%s previously vs street 23% YoY USD, 30% YoY NTD) For 3Q24, management guided revenue to be in the range of US$22.4-23.2bn (+9.5% QoQ at midpoint; based on FX of 32.5), GM in the range of 53.5-55.5%, and OpM in the range of 42.5-44.5%. GPM guide ahead of street implies HSD upside to Street’s 3Q24 EPS of 11.3 NTD before the call. (Company data, Mirae Asset)

Samsung HBM3e to ramp in 2H24

The company will increase HBM3E sales portion and capacity expansion. 3e8H mass production in 3Q, 3e12H ramp in 2H24. HBM3e’s share in HBM sales to exceed mid-teen in 3Q and high-60% by 4Q. HBM bit shipment to increase by 4x in 2024, 2x in 2025. Management expect memory ASP recovery to continue with modest demand growth in 3Q. (Company data)

Stock Comments

Naura Technology, China domestic CAPEX on track to see solid growth as domestic memory and logic production are expected to ramp over the next few years. Naura is well positioned as one of the domestic leader in semiconductor equipment.

SMIC, Domestic foundry utilization continues to recover on restocking orders. Regional mature foundries like UMC also reported better than feared margins provide support to the foundry segment sentiment.

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. Currently we are still in the process of cycle recovery as both stocks and earnings are below previous peak. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2024.9

1 CPCA, July 2024

2 Morgan Stanley, August 2024

3 Goldman Sachs, July 2024

4 NDRC, July 2024

5 Morgan Stanley, July 2024

6 UBS, August 2024

7 Company data, July 2024

8 Morgan Stanley, July 2024

9 Mirae Asset, August 2024

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus. This document has been approved for issue in the United Kingdom by Mirae Asset Global Investments (UK) Ltd, a company incorporated in England & Wales with registered number 06044802, and having its registered office at 4th Floor, 4-6 Royal Exchange Buildings, London EC3V 3NL, United Kingdom. Mirae Asset Global Investments (UK) Ltd. is authorised and regulated by the Financial Conduct Authority with firm reference number 467535.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.