THIS MATERIAL IS A MARKETING COMMUNICATION.

Monthly Commentary on Key Themes – July 2024

China and Asia Semiconductor

Industry Update

- SMIC 1Q results better than expected, China domestic foundry gradually recover: 1Q24 Rev of US$1.75bn (+4% QoQ) and GM of 13.7% were higher than guidance. 2Q24 revenues to grow 5%~7% QoQ, ahead of street. 2Q24 GM is guided at 9%~11% (vs. 13.7% in 1Q24), trending down on increasing depreciation. Management expects full year revenue rate to exceed industry growth (project 8% YoY growth for mature foundry), street at 10% YoY growth for FY24.1

Capacity increased to 814.5k wpm (8'' equivalent) by 1Q24, vs. 805.5k wpm in 4Q23; UT rates at 80.8%, vs. 76.8% in 4Q23. Management expects CAPEX to peak in 2024/25, and think significant capacity expansion is unlikely at the mature node even amid supply chain decoupling when UTR is too low. SMIC is adding 60k wpm this year, with 7.5bn USD CAPEX.2 - Hua Hong announced 1Q results, and investors look for analog demand to bottom out: Hua Hong guided for 2Q24 revenue of US$470-500mn (up 2-9% Q/Q), GPM 6-10%. Utilization is better sequentially thanks to sustained demand from CIS (capacity full throughout the year) and PMIC. Investors turn more positive on the stock given the relatively lower channel inventory for domestic analog suppliers.3

Stock Comments

- SMIC (+7.02%): Solid 1Q results and 2Q guidance drive the stock higher. 2Q24 revenues to grow 5%~7% QoQ, ahead of street. Investors look to buy the cycle recovery as demand gradually picks up across various downstream applications.

- TongFu Microelectronics (+9.49%): Packaging demand started to recover as the company reported solid 1Q24 results, and revenue grew 14% YoY. The company is acquiring KYEC’s China capacity which covers logic, memory and analog applications. The acquisition will help Tongfu increase its market share in the China market.4

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. Currently we are still in the process of cycle recovery as both stocks and earnings are below previous peak. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2024. 5

China Robotics and AI ETF

Industry Update:

Domestic industrial automation demand recovery remains sluggish in June. The order recovery in some traditional industries was sustained. Consumption-related downstream export demand was relatively solid but softened on a mom basis. Leading domestic companies IA orders grew slightly YoY in June, dragged by new energy industries, but were continuously gaining market share from foreign brands.

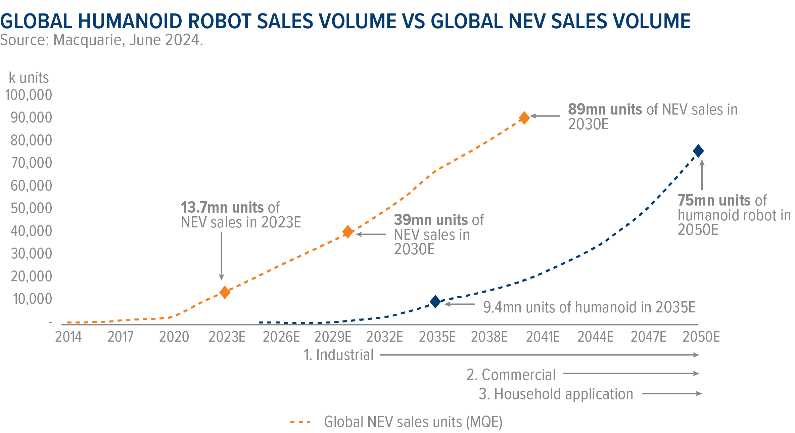

Tesla’s new generation of humanoid robot will be launched at the end of this year,6 which may speed up the growth of the global humanoid robotics market in the coming years. Tesla’s robot is leading in software and hardware integration, cost control and commercialization. Company mentioned recently that the new robot is working at the production line and being internal tested. We may expect more followers coming out after Tesla proves the mature production and manufacturing system.

Stock Comments

Zhongji Innolight (300308 CH)

1Q24 net income surged 304% YoY to Rmb1.0bn, 29% above street, thanks to strong 164% YoY revenue growth to Rmb4.8bn(26% ahead of street consensus), and 3.2ppts YoY(-2.6ppts QoQ) gross margin expansion in 1Q24 to 32.8%. During earnings call, management expected 800G ramp to accelerate sequentially and QoQ margin expansion ahead on better product mix, higher yield and cost-down. We didn’t see any fundamentals worsening in the last month. Company remains on the growth trajectory.

Nari Technology (600406 CH)

China posted the announcement to accelerate UHV lines construction in June, for which Nari is one of the key beneficiaries. Company’s new orders YTD beat expectations at 12%, vs revenue guidance of 8.6% this year. Distribution grid and digitalization capex are likely to ramp up with NEA’ latest policies.

Beijing Kingsoft Office Software (688111 CH)

The company provided preview for its upcoming quarterly results. Overall tune remained bearish with a potential downward revision of revenue and earnings, due to weak customer spending amid a continuous macro headwinds.

Preview

China industrial automation market has bottomed, though we are still not seeing any signals of out. The drag from new energy sectors are much more severe than expected and will likely last longer. On the bright side, first, demand recovery from traditional industries are better than expected. Second, exporting is accelerating despite at the very early stage and on a low base. Last but not the least, local companies are proactively optimizing their product mix and penetrating to new customers or existing customers’ new product lines, gaining market share from foreign brands, which partially offset the negative impact on sales and profits due to demand slowdown. We anticipate the L-shape recovery may continue in 3Q24.

Humanoid robot has been a key AI application trend. According to Macquarie’s recent estimates, global sales volume for humanoid robots to reach 9.4 million units by 2035E with a CAGR of 69% over 2025-2035E and market size to reach US$209bn with a CAGR of 50% over the same time. 7 Market has been doubtful on the on-the-ground presence of AI in real industrial applications. Should Tesla prove their products effectiveness in the manufacturing lines, we’ll see a reliable way for commercialization and monetization in China in the foreseeable future.

China Electric Vehicle and Battery

Industry Update:

- Solid June EV sales; EV penetration on the rise: According to CPCA, June passenger NEV wholesale volume reached 970k, +28% YoY and +8% MoM.8 Based on the announcements of individual auto brands, BYD reported June NEV sales of 342k units, +35% YoY, back to the historical peak monthly sales level in Dec 2023, driven mainly by solid demand for the DM-i 5.0, (Qin L/Seal 06) and promotions on the DM-i 4.0/Denza. 9 Other major EV brands recorded robust growth, with NIO (+98% YoY) registering record delivers of 21,209 units in June, and Li Auto seeing re-acceleration in growth (+47% YoY). (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF). Based on insurance registration, new energy vehicle (NEV) penetration was 44% in the last week of June. 10

- Xiaomi and Huawei maintain strong momentum: Xiaomi delivered 11.6k units of SU7 in June 2024,11+34% MoM. Xiaomi will continue to ramp up capacity and will accelerate delivery in July. 12 Huawei AITO M9 total order exceeded 100k units 6 months after launches, AITO M7 Ultra delivery reached 20k units 1 month after launches.13

- EV Battery sales grew by 2% MoM to 56 GWh in May, and ESS battery sales grew by 18% MoM to 22 GWh. Exports for EV batteries increased to 10 GWh and ESS batteries exports rose to 4.0 GWh in May.14 May EV battery installations reached 40GWh in May, +41% YoY. CATL reported 43% market share in domestic installations in May, +2ppts YoY, and BYD share was 29%.

- EU tariff: On 12 June, European Commission disclosed the level of provisional countervailing duties on China BEV imports. Additional duties are applied to China EV brands on top of existing 10% tariff, and individual additional duties for three sampled Chinese EV producers BYD, Geely and SAIC will be 17.4%, 20% and 38.1%, respectively. The new tariff is effective on 4 July.

- Battery material costs further declined in June: China’s spot lithium carbonate price declined by 12% MoM to around RMB 93 k/t at the end of June. 15 Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

Stock Comments

BYD (002594.CH)

BYD’s share price was up 10% in June. BYD launched Qin L and Seal 06, powered by DM-i 5, at the end of May, and recorded strong demand in June. EU’s announcement on 17.4% additional tariff on BYD export has been expected by the market, and we note that the incremental tariff is targeting BEV (Battery Electric Vehicle), but does not include PHEV (Plug-in Hybrid Electric Vehicle). This could create opportunity for BYD’s DM-i technology powered PHEVs to capture market, as its SEAL U DM-i is set to launch in Europe in 3Q24

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand and export sales should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive in 2024 with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands. Recent signs of battery inventory cycle bottoming out after destocking last year implies a normalized industry landscape that could lead to a better margin profile for battery industry leaders.

China Clean Energy

Industry update

- Solar – Polysilicon prices further declined: Solar polysilicon prices were Rmb39/kg by the end of June16, further decreased by over 5% compared to one month ago, implying that most providers are cash-cost loss making. Polysilicon production is expected to fall by 18% MoM in June as more capacity is going into overhaul, potentially leading to price stabilization.17 Module prices remain weak, with module maker’s utilization rates increased in June. Solar module and inverter export volume recorded mild MoM improvement in May, suggesting recovering demand in Europe.

- Positive policy for Solar supply-side control: In June, China National Energy Administration's Renewable Energy Department reiterated its support for the healthy development of the solar industry. Regulator aims to guide the healthy capacity expansion for solar industry and improve technology innovation ability with enhanced industry standard. The exit of excessive capacity and more disciplined capacity expansion should support profitability improvement for major players.

- Grid and power installation – Solid wind and solar installations growth; Grid investments accelerating: China’s Jan-May 2024 wind installations grew+21% YoY while solar installations expanded +29% YoY over the same period. In Jan-May 2024, the electricity grid spending in China reached Rmb170.3bn. +22% YoY.18 Action Plan for Energy Conservation and Carbon Reduction during 2024-25 issued in May also promotes the acceleration in construction of ultra-high-voltage (UHV) transmission lines and grid system upgrades to lower renewable curtailment,19 which bodes well for industry development.

Stock Comments

China Yangtze Power (600900 CH)

Recorded 9% total returns in June. Benefiting from the strong hydropower resources, Yangtze Power reported 2Q24 power generation growth of +43% YoY to 67.9bn KWh. In addition, July water inflow in Three Gorges remained strong, implying solid momentum of hydropower resources could continue in 3Q24. Yangtze Power is currently trading at 3.4% 2024E dividend yield for 2024E, its dividend payout could be well supported due to its strong cash flow and less capex ahead.20

Preview

We are optimistic about the structural growth profile in renewable development, with China taking the leading position globally, particularly in the solar supply chain. Robust power demand growth as driven by AI and EV development is driving up global power demand. However, it is worth noting that the solar supply chain entered a consolidation phase starting 2023, as it has taken time for the industry to digest excess capacity in the past few years. We believe the profitability for the value chain will stay constrained, and players who can keep a good balance sheet and maintain technology leadership will be the long-term winners. In addition, hydro power can be a key beneficiary for potential power reform thanks to its lower cost, and more stable and manageable power output compared with wind and solar.

China Cloud Computing

Industry update

In May 2024, China Software industry revenues were +11.8% YoY, leading 5M24 total industry revenue growth at 11.6% to Rmb4,932bn. 5M24 revenue from IT services +13% YoY, while revenue from software products and cybersecurity were +9%, similar trend as compared to 4M24.

May China telecom industry revenue grew 2.5% YoY, still weak. Mobile revenue fell 5.1% YoY (-2.1% YTD) indicating ARPU pressure. May fixed line rev growth accelerated to 6.3% YoY with YTD growth of 5.2%. 5G industrial internet revenue recovered to ~16% YoY in May, a six-month high.

Stock Comments

Netease Inc Sponsored ADR

Stock price reacted positively to the recent announcement of new game release timeline. Blizzard China announced the return of World of Warcraft in China on Aug 1, and the expansion pack "The War Within" will be released globally on Aug 27. In addition, Naraka: Bladepoint Mobile

will be released on 25 Jul. It has a large pre-registration gamer base which focuses on game balance and innovations. A number of features are highlighted, such as Copilot (AI teammate), which enables gamers to interact through voice communications. In addition, new users should pick up the game play easily.

Tencent Holdings Ltd

Tencent’s overseas games continued to surprise positively since start of the year. Tencent has been expanding its games overseas via building in-house studios and acquisitions of overseas studios. These investments are starting to bear fruit, e.g. strong grossing of PUBG Mobile and Brawl Stars, according to SensorTower, July 2024.

Beijing Kingsoft Office Software. Inc. Class A

The company provided preview for its upcoming quarterly results. Overall tune remained bearish with a potential downward revision of revenue and earnings, due to weak customer spending amid a continuous macro headwind.

Thunder Software Technology Co., Ltd. Class A

Momentum tapered off post the announcement of collaboration with Qualcomm on AI PC platform as there’s no immediate revenue contribution yet.

China Consumer Brand

Industry Update

China national online retail GMV grew 13% in May, largely driven by front-loaded sales due to an earlier start of the 618 Shopping Festival and cancellation of the pre-sales period this year. For the 618 Shopping Festival that concluded on June 20th, Leading platforms no longer report headline GMV growth but market expect mid-to-high single digit industry GMV growth, and a flattish to teens sales growth for individual traditional and livestreaming e-commerce platforms. Return rated edged up for categories including apparel as consumers become more price sensitive and cautious in terms of their purchasing behaviors. Competition remained intense with leading platforms offering traffic support and promotions to attract merchants (especially small to medium-sized merchants) and consumers.

Domestic demands for sportswear, baijiu, beer and restaurant were weaker than expected into the month of June. Macau's gross gaming revenue (GGR) came in at MOP17.7bn in June at 74% of the pre-COVID19 level vs. 79%/78% in Apr/May, likely due to weaker seasonality.

Stock Comments

Fuyao Glass Industry Group Co., Ltd. Class A

The company expects a stabilized profitability level with upward potentials driven by a potential decline in soda ash cost and improving utilization rate. Moreover, a 6-7% price hike will drive revenue growth.

Tingyi (Cayman Islands) Holding Corp.

Share price reacted positively to the recent robust demand for beverage. On the other hand, demands for noodles were weak. Beverage segment grew lower than HSD% in Jan-May while Noodle segment slightly declined but turned positive in May with product upgrade. Both segments saw margin improvement YTD in both GPM and NPM.

Kweichow Moutai Co., Ltd. Class A.

First-tier wholesale ASP of Feitian Moutai declined from ~Rmb2,500 to ~Rmb2,150 mainly due to weaker than expected demands. This have resulted in some market concerns and short-term stock price pressure. In recent weeks, wholesale price rebounded to Rmb2,200+ as the company released price stabilization measures.

India Market

Industry Update

- India’s strong economic growth continued driven by robust domestic demand, supported by both consumption and investments. Private consumption is likely to become more broad-based as rural consumption improves thanks to expectations of a favorable monsoon this year. In addition, the improving outlook for global trade is leading to an uptick in exports and is likely to support the overall growth outlook. Furthermore, the softening trend in core CPI seems encouraging and price stability is expected to stay, which is also supportive to a sustained growth.

The current account recorded a surplus of 0.6% pf GDP (US$5.7bn) in 4QFY24 improved from a deficit of 1% of GDP(US$8.7bn) in 3QFY24. Merchandise trade deficit narrowed as exports improved sequentially while imports moderated slightly. Gross service exports increased 4.1% while net services exports grew 9.2%yoy in 4QFY24. The current account surplus improved to a three quarter high and overall balance of payments (BoP) surplus accelerated to US$30.8bn or 3.3% of GDP from US$6bn (0.7% of GDP) in the previous quarter. The overall BoP surplus recorded US$63.7bn or 1.8% of GDP for the full year FY24.

Stock Comments

Infosys (INFO IN) - As the industry heads towards stability in spend for 2HCY24. The companies had baked in easy assumptions on discretionary spends for the year and Infosys is likely to record sequential revenue growth based on ramps in mega deal wins of FY24. Accenture reported its results during the month and the company indicated acceleration in growth for next year also contributed to positive sentiment towards Indian IT sector.

Larsen & Toubro (LT IN) - As the market increasingly concerned on whether the government would reduce investments and increase allocation more towards on private consumption after the election. In addition, there is limited near term catalysts given relatively moderate orders. Near term, the market will be watching out for the upcoming central government budget in July.

Preview

This confluence of strong GDP growth, moderate inflation, and recovery in consumption suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. In the near term, trend in monsoon rainfall, budget for FY2025 in July will be the major event to watch out for the market.

1 Company data, June 2024

2 Company data, June 2024

3 Company data, June 2024

4 Company data, June 2024

5 Mirae Asset, June 2024

6 Company data, June 2024

7 Macquarie, June 2024

8 CPCA, July 2024

9 Morgan Stanley, July 2024

10 Goldman Sachs, July 2024

11 CPCA, July 2024

12 Company Data, July 2024

13 Huawei, July 2024

14 UBS, CABIA, June 2024

15 UBS, July 2024

16 UBS, June 2024

17 UBS, Silicon China, June 2024

18 National Energy Administration, June 2024

19 Xinhua, May 2024

20 UBS, July 2024

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus. This document has been approved for issue in the United Kingdom by Mirae Asset Global Investments (UK) Ltd, a company incorporated in England & Wales with registered number 06044802, and having its registered office at 4th Floor, 4-6 Royal Exchange Buildings, London EC3V 3NL, United Kingdom. Mirae Asset Global Investments (UK) Ltd. is authorised and regulated by the Financial Conduct Authority with firm reference number 467535.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.