THIS MATERIAL IS A MARKETING COMMUNICATION.

Monthly Commentary on Key Themes – May 2024

China and Asia Semiconductor

Industry Update

- Asia supply chain to benefit from upward CAPEX revision in key US hyperscaler on stronger AI investment: Meta increased the full-year CAPEX guide to 35-40bn USD from 30-37bn USD to accelerate infrastructure investment for AI. Microsoft's March quarter CAPEX came in at 14bn vs street at 13bn.1 Management expects capital expenditures to increase materially on a sequential basis, driven by cloud and AI infrastructure investments.2 Higher than expected growth in Azure (+31% YoY vs guide 28%) supports the thesis for CAPEX sustainability. Google 1Q CAPEX was 12bn, management guided a similar or higher level for the next 3 quarters of the year. (vs street at around 10bn per quarter CAPEX run rate)3 (Nvidia 2024).

- Asia semiconductor supply chain is well positioned to benefit from increasing AI investment. Majority of the AI supply chain from chip level to server and rack level is located in Asia. TSMC is the foundry partner for most AI GPU and ASIC projects, while SK Hynix is the major supplier in HBM (high bandwidth memory) for AI chips.

- SK Hynix announced strong 1Q results: SK Hynix posted revenue of W12.4tr and operating profit of W2.9tr, above the latest consensus estimates of W2.2tr profit. The solid result was supported by sequential improvement in both DRAM and NAND price, with NAND price up over 30% QoQ in 1Q24.

Stock Comments

- SG Micro (+19.44%): SG Micro’s 1Q24 GM was a surprise at 52.5%, vs 47.2% in 4Q23 thanks to better product mix and continuing recovery in consuming electronics sector. Market turn more positive on the analog cycle as TI cut production amid elevated in-house inventory and pricing stabilize across the market.

- Montage Technology (+9.58%): 1Q24 revenue surged 76% YoY to Rmb737mn and net profit expanded to Rmb223mn (vs. Rmb20mn in 1Q23), both are in-line with profit alert. DDR4 RCD shipment recovered in 1Q24 after downstream inventory normalization from 4Q23, with DDR5 RCD shipment accounting for c.40% of total RCD shipment, reflecting recovering downstream demand.

Preview

Increasing AI adoption in the datacenter and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI enabled devices have much higher semi content. Currently we are still in the process of cycle recovery as both stocks and earnings are below previous peak. We expect volume growth in end device to drive broad based semiconductor cycle recovery in 2024. 4

China Robotics and AI

Industry Update

- China industrial robotics sales volume grew by 4.8% in 1Q24.5 Robot demand from the home appliance, 3C and auto electrics segments grew by 9%+, but declined for lithium battery and photovoltaic (PV) robotics. FANUC, Estun, Inovance and KUKA remained top-4 suppliers, while for the first time there are 2 domestic suppliers in the top 4.6

Stock Comments

- Zhongji Innolight (300308 CH): 1Q24 net income surged 304% YoY to Rmb1.0bn, 29% above street, thanks to strong 164% YoY revenue growth to Rmb4.8bn(26% ahead of street consensus)7, and 3.2ppts YoY(-2.6ppts QoQ) gross margin expansion in 1Q24 to 32.8%. During earnings call, management expected 800G ramp to accelerate sequentially and QoQ margin expansion ahead on better product mix, higher yield and cost-down. 8

- Montage Technology (688008 CH): 1Q24 revenue surged 76% YoY to Rmb737mn and net profit expanded to Rmb223mn (vs. Rmb20mn in 1Q23), both are in-line with profit alert. DDR4 RCD shipment recovered in 1Q24 after downstream inventory normalization from 4Q23, with DDR5 RCD shipment accounting for c.40% of total RCD shipment, reflecting recovering downstream demand.

- iFlytek (002230 CH): Share price has been weak for the month as market remains concerned on 1Q24 results of the company with elevated operating loss. iFlytek's 1Q24 revenue rose 26% YoY, but net loss reached the record-high level of RMB300mn, mainly due to gross margin contraction of government-related business. Since the launch of iFlytek LLM Spark in May 2023, the Company has received positive feedback from consumers, especially on products such as learning pad with 99% YoY rev. growth for learning pad in 1Q. In addition, SOEs show strong interest in AI application and monetization is on the way. However, tight government budget and continuing investment are short-term headwinds, and AI revenue contribution is relatively small and cannot offset the negative impact.

Preview

We anticipate industrial robot demand in China remain positive growing in 2024 (vs 2023: +0.4%), 9driven by broad downstream applications and governmental stimulus in manufacturing equipment renewals. Domestic players (e.g. Estun and Inovance) continued to gain market share, though there could be back and forth looking ahead.

For AI, leading software and internet companies have been investing in hardware and talents to drive continuous upgrade of their large language models, e.g. SenseTime released its new LLM SenseNova 5.0 LLM, which receives high market attention. New AI start-up like Moonshot has been developing LLMs that can handle long inputs of text and data, has raised over $1 billion in a Series B round from investors including Alibaba and Meituan10. Overall, we remain optimistic about AI monetization in China, whereas near-term process of monetization in different industries will be key to drive software companies’ stock price.

China Electric Vehicle and Battery

Industry Update:

- Solid April EV sales; EV penetration on the rise: According to CPCA estimates, April passenger NEV retail sales reached 720k, +37% YoY.11 Based on the announcements of individual auto brands, BYD reported April NEV sales of 312k units, +49% YoY, driven by the solid sales momentum of "Honor" facelifts with minor spec upgrades but meaningful price cuts of 10-20%. Overseas sales up 7% MoM to a record level of 41k units. Other major EV brands recorded divergent performance, with NIO (+135% YoY) showing accelerating sales growth driven by discounts, while Li Auto (flat % YoY) and XPeng (+33% YoY) delivered a relatively slow start in April. (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF). Based on insurance registration, new energy vehicle (NEV) penetration remained at a high level of 45.5% in the last week of April.12

- Trade in stimulus to support 2024 volume growth: On 26 April, a detailed plan for auto trade in program offering one-time subsidy for car replacements was jointly announced by 7 central government departments. Consumers replacing their old cars with NEVs will be entitled for Rmb10k subsidy, and those who choose to purchase new ICE vehicles with displacement of 2.0L or less will be granted less subsidy. The new trade in program is generally better than expected both in terms of ranges of eligible vehicles and amounts of subsidies, which can support EV demand throughout the year.

- Battery inventory cycle bottoming out: According to the China Automotive Battery Innovation Alliance (CABIA), China’s EV battery installation was up 95% MoM.13 EV battery inventory has been in a continuous destocking cycle and there are signs of bottoming out, with global battery inventory months dropping significantly to 1.4 months in Feb 2024 from 3.5 months one year ago. CATL continued to expand market shareto 45%, while BYD’s share stayed relatively flat YoY at 27%14.

- Battery material costs stabilizes in April: China’s spot lithium carbonate price was stabilised at around RMB 112 k/t at the end of April15. Battery materials prices have decreased by over 80% from its peak in Feb 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

- Beijing Auto Show 2024 was held between 25 April and 4 May, during which 117 global premieres (including 30 global premieres by multinational companies), 41 concept cars, and 278 NEV models were showcased. Top executives of EV brands, especially Xiaomi’s CEO Mr. Lei Jun, gained massive attention during the show and was widely discussed on the internet. The tech giant is disrupting China EV landscape with its highly interactive product ecosystem, large user base, and unique fans culture. Following the successful debut of SU7 on 28 March, Xiaomi has locked c.75k orders as of 25 April, and targets to deliver 100k for 2024.

Stock Comments

- BYD (002594.CH): BYD’s share price was up 5% in April, a positive contributor to the ETF. BYD reported 1Q24 results with Net Profit of Rmb 4.6bn, +11% YoY and largely in line with market expectation. Notably, its NEV GPM expanded by an impressive to 28%16, driven by higher contributions from premium brands and exports, as well as supply chain cost reduction, though partially offset by unprecedented price cut during the quarter. Though current industry price competition shows no signs of easing as the majority of OEMs still prioritize NEV market share over profitability, the solid profitability for BYD indicates the capability of leading OEMs to weather through competition thanks to more appealing products and higher operational efficiency. BYD has announced a series of high-end models including Denza Z9 and Bao 8 to be launched throughout the year, its product mix upgrades should also contribute to a resilient profitability in 2024.

- CATL (300750.CH): CATL’s share price was up 10% in April, a positive contributor to the ETF. CATL’s 1Q24 results showed solid unit battery profitability, which is likely to sustain throughout 2024, driven by improving product mix and efficient cost control. 17 Management expected utilization to show ongoing improvement and reach high level. In Beijing Auto Show 2024, CATL unveiled a new generation super charging battery – Shenxing Plus - supporting 1,000km range and featuring 600km range/10 min charge. The strong product capacity upgrade within short timeframe demonstrates the leading R&D capacity for CATL, which should support its further market share gain globally.

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward global EV penetration trajectory. Domestic old car replacement demand and export sales should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive in 2024 with strong new product line-up from EV brands and new entrants such as Xiaomi. Though intensifying competition among EV brands remains the key concern with major EV brands announcing fierce price cut in the past 2 months, we are seeing a rapid consumer interest rebound for key EV models18 after price cut announcements, which should be a leading indicator for sales and further drive up EV penetration. In addition, recent signs of battery inventory cycle bottoming out after destocking last year implies a normalized industry landscape that could lead to a better margin profile for battery industry leaders.

China Clean Energy

Industry update

- Solar – Polysilicon prices declined: Solar polysilicon prices were Rmb49/kg by the end of April, decreased by over 25% compared to one month ago, and were lower than most companies’ cash costs19. Increased polysilicon supply and inventory pressure from wafer could weigh on polysilicon price. Module prices saw a mild decline MoM, and some manufacturers plan to reduce May production to control module supply, according to PV Infolink.20 Solar module and inverter export recorded MoM improvement in March, with the destocking in EU nearing completion and could recover in 2Q24.21 Solar glass prices increased by 12% MoM and Inventory levels decreased MoM to 19 days, implying demand recovery.

- Grid and power installation – Strong wind and solar installations; grid Capex delivered mild growth: China’s Jan-Mar 2024 wind installations grew+49% YoY while solar installations expanded +36% YoY over the same period. In Jan-Mar 2024, the electricity grid spending in China reached Rmb76.6bn. +15% YoY.22 The National Development and Reform Commission and National Energy Administration jointly issued on 1 March the Guidance on high-quality development for the power grid distribution network. It sets multiple medium-term (by 2025) and long-term (by 2030) targets for improving the smartness and stability of the distribution power grid.

Stock Comments

- Sungrow (300274 CH): Sungrow’s share price was relatively flat in April, a positive contribution to the ETF. Sungrow reported better than expected 1Q24 results, driven by solid gross margin for Energy Storage System (ESS) and solar inverter. 23 Across solar value chain, Sungrow displays more resilient profitability under a more favourable competitive landscape for ESS thanks to its technology leadership and solid track record. Sungrow is poised to benefit from the global solar demand growth and further expand its market share for inverter globally.24

Preview

We are optimistic about the structural growth profile in renewable development, with China taking the leading position globally, particularly in the solar supply chain. However, it is worth noting that the solar supply chain entered a consolidation phase starting 2023, as it has taken time for the industry to digest excess capacity in the past few years. We believe the profitability for the value chain will stay constrained, and players who can keep a good balance sheet and maintain technology leadership will be the long-term winners. We are bullish on the electrical equipment players who benefit from increased grid and system investment in China and globally. They enjoyed a higher selling price and volume growth amid global equipment tightness.

China Consumer Brand

Industry Update

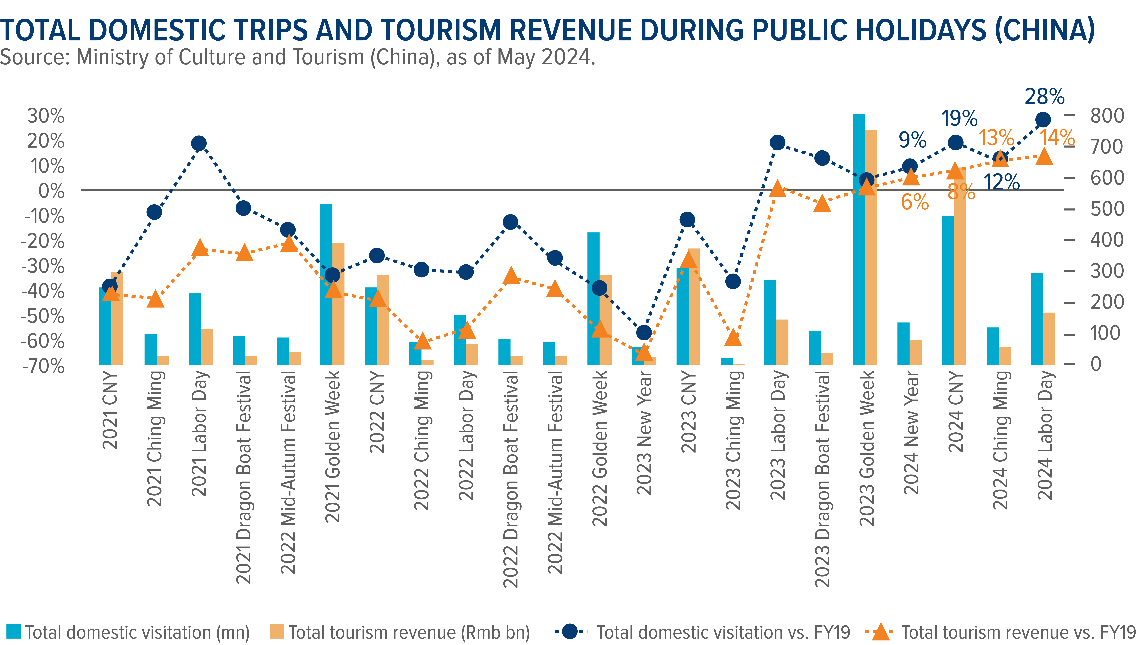

- For the Labor Day holiday, total China domestic traffic was 295mn on May 1 – 5th, 8% YoY, according to the Ministry of Culture and Tourism. This is a 28% increase vs. FY2019 levels, an improvement from +19%/+12% during the CNY and Qingming holidays. Tourism revenue came in at Rmb167bn, +14%25 vs. FY2019 levels, implying that each traveler still spent less than what they used to pre-Covid.

- By segments, outbound travel demands were strong. Outbound tourism traffic was up 40% yoy26, benefiting from increased flight capacity, easing visa controls, and favorable FX. Long-haul destinations further accelerated from previous holidays, benefiting from easing visa policies. Hainan's DFS sales fell -38% yoy on both fewer shoppers and lower per-head spending potentially due to extreme weather conditions and traffic dilution to overseas.

Stock Comments

- Haier Smart Home (600690 CH), Midea Group (000333 CH): White goods sector’s stock price performance were relatively strong YTD, mainly because 1) both domestic and overseas AC production volume growth remained robust, according to China IOL. Into 2Q24, China IOL revised up overseas AC production planning to +27% in 2Q24, from +17% previously, mainly driven by robust demand in Middle East, Southeast Asia, and Latin America, boosted by re-stocking in preparation for rising raw material costs, 2) potential stimulus policy (subsidy program) released by the government that can drive an uplift of the overall industry revenue growth for FY2024. In addition, Haier and Midea both offer attractive dividend yield which could provide stable shareholder return.

- Li Auto (LI US): On April 22, Li Auto cut prices of its entire model lineup except for the newly-launched L6. The cuts of Rmb18-30k – the first time the company officially cut MSRP, amid continuously intensifying competition within the China EV industry. Stock price reacted negatively to the price cut.

Preview

China consumer sector share price rebounded for the month of April. Since start of the year, consumer demands for sectors like travel remained strong, mostly driven by pent-up demands and improved airline capacity. OTA and hotels were the key beneficiary of a solid travel demand.

Moreover, consumer sentiment seems to be stabilizing from second half last year, when overall macroeconomy remained weak despite the reopening. Most of the China consumer companies already reported 1Q24 earnings. Sales are better than feared on a tough comp with online, lower-tier cities, experience-related consumption leading the growth. Overseas growth is a bright spot for home durables (white goods and cleaning appliances), IP concept retailers, apparel & footwear OEMs, pet food. Local brands in general outperformed MNC brands considering the price points and product cycles.

Into 2Q24, consumer companies’ earnings will be more important to support a continuous share price rally. Key events post Labor Day holiday consumption will be 618 promotion events and the Paris Summer Olympics, which are critical for product launches and promotional/marketing activities.

China Cloud Computing

Industry Update

In March 2024, China Software industry revenues were +11.9% YoY, driving 1Q24 total industry revenue growth at 11.9% to Rmb2,802bn.27 Revenue from software products +10.8% YoY to Rmb288.9bn during this period, while revenue from IT services +12% YoY to Rmb716.5bn. Security software revenue +3% YoY to Rmb6.3bn, and Embedded system software revenue +15.6% YoY to Rmb85.2bn.

Stock Comments

- Tencent Holdings (700 HK): Tencent share price remained strong as compared to overall MSCI China index, as market expects the company’s domestic game revenue to reaccelerate into 2Q24 with the release of long-anticipated DnF Mobile.28 For international games, Q1 Supercell's 1Q24 revenue rose 82% YoY with Brawl Stars as the core driver. In addition, PUBG's global revenue has risen since H223 and was up 34% YoY in Q129, due to improving monetization and its relaunch in India. Both trends should have supported a meaningful improvement for Tencent’s international games since 4Q23.

- SenseTime (20 HK): The company releases its new LLM SenseNova 5.0 LLM, which receives high market attention. For FY2023 earnings results, 2023 revenue declined 11% YoY with net loss expanding 7% YoY to Rmb6.4bn30, dragged by the smart city business. SenseTime’s increasing revenue mix from generative AI has shortened the overall cash conversion cycle, compared to smart city business with longer cash conversion.

- iFlytek (002230 CH): Share price has been weak for the month as market remains concerned on 1Q24 results for potentially elevated operating loss. iFlytek's 1Q24 revenue rose 26% YoY, but net loss reached the record-high level of Rmb300mn, mainly due to gross margin contraction of government-related business. Since the launch of iFlytek LLM Spark in May 2023, the Company has received positive feedback from consumers, especially on products such as learning pad with 99% YoY rev. growth in 1Q. In addition, SOEs show strong interest in AI application and monetization is on the way. However, tight government budget and continuing investment are short-term headwinds, and AI revenue contribution is relatively small and cannot offset the negative impacts.

Preview

China software industry revenue growth remained weak as compared to pre-Covid, due to no signs of a meaningful recovery of the overall local government and private enterprise IT spending amid a fluid macroeconomic condition.

For AI, leading software and internet companies have been investing in hardware and talents to drive continuous upgrade of their large language models, e.g. SenseTime released its new LLM SenseNova 5.0 LLM, which receives

high market attention. New AI start-up like Moonshot AI, which has been developing LLMs that can handle long inputs of text and data, has raised over $1 billion in a Series B round from investors including Alibaba and Meituan.

Overall, we remain optimistic about AI monetization in China, whereas near-term process of monetization in different industries will be key to drive software companies’ stock price.

India Market update

Market Update

- We remain constructive on India’s growth outlook. Domestic demand continued to show strength in April with GST collections reaching to record highs at Rs 2.1tn, up 12.4%yoy, while manufacturing PMI slightly softened to 58.8. Credit growth remained strong rising 16.1%yoy during the month. Services PMI slowed to 60.8 in April yet it continues to remain above 60 levels for 4 consecutive months thanks to robust demand and increasing new orders. India showed a robust growth in FY24 thanks to capex/industrial activity momentum and we expect FY25 growth to be more broad-based with narrowing gaps between private-public capex and rural-urban consumption.

- India’s general election kicked off on 19th April and will continue till 1st June, with counting on the June 4th. In the first two phases so far, voter turnout has been below the trend see in last election and historically, lower voter turnout in a general election has not helped the incumbent. That said, there are still 5 phases left and the market participants will be watching out for the turnout for third phase. In the past, the market has experienced an extended period of elevated volatility around election period but we expect less volatility this time as it is widely anticipated for BJP, the ruling political party under the incumbent Prime Minster Modi, to win the general elections, and thus the likelihood of alteration in major policies is expected to be limited.

Stock Comments

- Bharti Airtel (BHARTI IN) share price remained strong in April thanks to improving competitive landscape of telecom sector in the country. The market has been very competitive since Reliance Jio’s entrance into the market which led consolidation of the industry. It seems industry participants are now aligned with the current market structure and expect the awaited tariff hike post-election to lead to ARPU hike in coming quarters which would lead to better returns on capital and FCF of the company.

- Sun Pharmaceutical (SUNP IN) Share price has been weak in April due to regulatory concerns in the US. FDA issued ‘Official Action Initiated’ status for Sun’s Dadra plant after the plant inspection in December 2023. OAI statuts means that the FDA found notable deviations from its prescribed GMP quality norms and it may withhold approval of new products from Dadra until the company fixes the issues. Thus, US generic sales is likely to remain range bound on FDA issues and low the visibility on launches.

Preview

This confluence of strong GDP growth, moderate inflation, and recovery in consumption suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. In the near term, national election will be the major event to watch out for the market.

1 Bloomberg, April 2024

2 Microsoft, April 2024

3 Bloomberg, April 2024

4 Mirae Asset, May 2024

5 MIR, May 2024

6 Macquarie, May 2024

7 Bloomberg, April 2024

8 Zhongji Innolight, April 2024

9 Mirae Asset, May 2024

10 36 Kr, February 2024

11 CPCA, CnEVPost, April 2024

12 Jefferies, May 2024

13 UBS, April 2024

14 UBS, April 2024

15 UBS, March 2024

16 Citi, April 2024

17 Morgan Stanley, April 2024

18 UBS, March 2024

19 UBS, April 2024

20 UBS, April 2024

21 UBS, April 2024

22 National Energy Administration, April 2024

23 UBS, April 2024

24 Macquarie, May 2024

25 the Ministry of Culture and Tourism, May 2024

26 the Ministry of Culture and Tourism, May 2024

27 MIIT, April 2024

28 Company data, April 2024

29 Company data, April 2024

30 Company data, April 2024

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus. This document has been approved for issue in the United Kingdom by Mirae Asset Global Investments (UK) Ltd, a company incorporated in England & Wales with registered number 06044802, and having its registered office at 4th Floor, 4-6 Royal Exchange Buildings, London EC3V 3NL, United Kingdom. Mirae Asset Global Investments (UK) Ltd. is authorised and regulated by the Financial Conduct Authority with firm reference number 467535.

Copyright 2024. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.